Overview

Introduction to Cryptocurrency Course Overview

This Introduction to Cryptocurrency course delivers a comprehensive overview of cryptocurrency. You will establish a working knowledge of blockchain fundamentals, such as digital keys, hash functions, and probabilistic finality. You will also learn how these technologies are used in cryptocurrencies and walk through a real-world transaction on the Bitcoin blockchain. Lastly, this course will teach you the different types of wallets that are used to hold cryptocurrencies. After completing this course, you will have a solid grasp on what cryptocurrencies are, the technology that underpins them, and how they compare to fiat money.

The Basics about Cryptocurrency

Cryptocurrency comes under many names. You have probably read about some of the most popular types of cryptocurrencies such as Bitcoin, Litecoin, and Ethereum. Cryptocurrencies are increasingly popular alternatives for online payments. Before converting real dollars, euros, pounds, or other traditional currencies into ₿ (the symbol for Bitcoin, the most popular cryptocurrency), you should understand what cryptocurrencies are, what the risks are in using cryptocurrencies, and how to protect your investment.

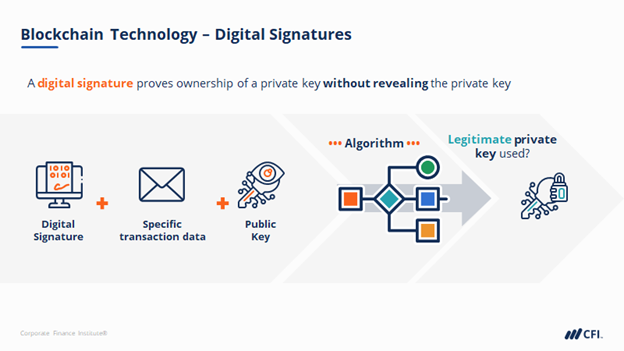

What is cryptocurrency? A cryptocurrency is a digital currency, which is an alternative form of payment created using encryption algorithms. The use of encryption technologies means that cryptocurrencies function both as a currency and as a virtual accounting system. To use cryptocurrencies, you need a cryptocurrency wallet. These wallets can be software that is a cloud-based service or is stored on your computer or on your mobile device. The wallets are the tool through which you store your encryption keys that confirm your identity and link to your cryptocurrency.

What are the risks to using cryptocurrency? Cryptocurrencies are still relatively new, and the market for these digital currencies is very volatile. Since cryptocurrencies don’t need banks or any other third party to regulate them; they tend to be uninsured and are hard to convert into a form of tangible currency (such as US dollars or euros.) In addition, since cryptocurrencies are technology-based intangible assets, they can be hacked like any other intangible technology asset. Finally, since you store your cryptocurrencies in a digital wallet, if you lose your wallet (or access to it or to wallet backups), you have lost your entire cryptocurrency investment.

Follow these tips to protect your cryptocurrencies:

- Look before you leap! Before investing in a cryptocurrency, be sure you understand how it works, where it can be used, and how to exchange it. Read the webpages for the currency itself (such as Ethereum, Bitcoin or Litecoin) so that you fully understand how it works, and read independent articles on the cryptocurrencies you are considering as well.

- Use a trustworthy wallet. It is going to take some research on your part to choose the right wallet for your needs. If you choose to manage your cryptocurrency wallet with a local application on your computer or mobile device, then you will need to protect this wallet at a level consistent with your investment. Just like you wouldn’t carry a million dollars around in a paper bag, don’t choose an unknown or lesser-known wallet to protect your cryptocurrency. You want to make sure that you use a trustworthy wallet.

- Have a backup strategy. Think about what happens if your computer or mobile device (or wherever you store your wallet) is lost or stolen or if you don’t otherwise have access to it. Without a backup strategy, you will have no way of getting your cryptocurrency back, and you could lose your investment.

Types of Cryptocurrency

What are the Main Types of Cryptocurrencies?

What are the Main Types of Cryptocurrencies?

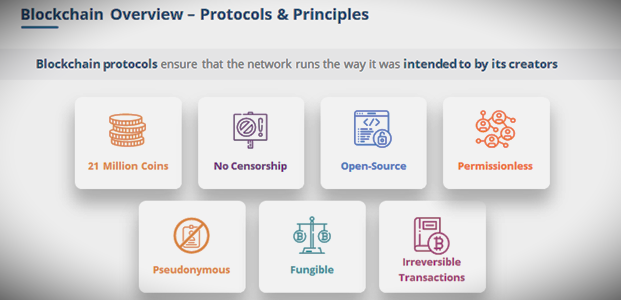

Presently, there are thousands of cryptocurrencies out there, with many more being started daily. While they all rely on the same premise of a consensus-based, decentralized, and immutable ledger in order to transfer value digitally between trustless parties, there are subtle and not-so-subtle differences between them.

This article will make sense of the landscape and look to help categorize cryptocurrencies into four broad types:

- Payment cryptocurrency

- Utility Tokens

- Stablecoins

- Central Bank Digital Currencies (CBDC)

Key Highlights

- There are thousands of cryptocurrencies out there, with many more being started daily, so how can we classify them?

- They all depend on blockchain technology, but there are many differences.

- Broadly speaking, we will classify them into four categories: Payment Cryptocurrencies, Tokens, Stablecoins, and Central Bank Digital Currencies.

Payment Cryptocurrency

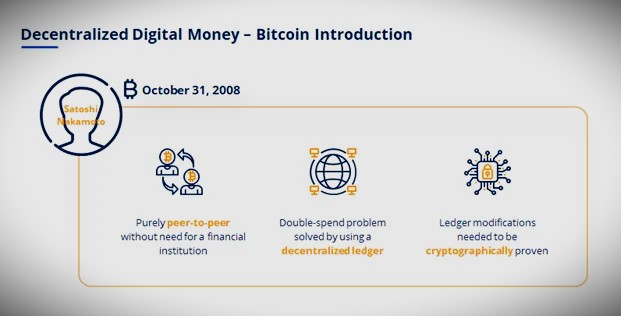

The first major type of cryptocurrency is payment cryptocurrency. Bitcoin, perhaps the most famous cryptocurrency, was the first successful example of a digital payment cryptocurrency. The purpose of a payment cryptocurrency, as the name implies, is not only as a medium of exchange but also as a purely peer-to-peer electronic cash to facilitate transactions.

Broadly speaking, since this type of cryptocurrency is meant to be a general-purpose currency, it has a dedicated blockchain that only supports that purpose. It means that smart contracts and decentralized applications (Dapps) cannot be run on these blockchains.

These payment cryptocurrencies also tend to have a limited number of digital coins that can ever be created, which makes them naturally deflationary. With less and less of these digital coins can be mined, the value of the digital currency is expected to rise.

Examples of payment cryptocurrencies include Bitcoin, Litecoin, Monero, Dogecoin, and Bitcoin Cash.

Utility Tokens

The second major type of cryptocurrency is the Utility Token. Tokens are any cryptographic asset that runs on top of another blockchain. Ethereum network was the first to incorporate the concept of allowing other crypto assets to piggyback on its blockchain.

As a matter of fact, Vitalik Buterin, the founder of Ethereum, envisioned his cryptocurrency as an open-sourced programmable money that could allow smart contracts and decentralized apps to disintermediate legacy financial and legal entities.

Another key difference between tokens and payment cryptocurrency is that tokens, like Ether on the Ethereum network, are not capped. These cryptocurrencies are, therefore, inflationary – meaning that since more and more of these tokens are created, the value of this digital asset should be expected to fall, like a fiat currency in a country that is constantly running its cash printing press.

A Utility Token serves a specific purpose or function on the blockchain, called a use case.

Ether’s use case, as an example, is for paying transaction fees to write something to the Ethereum blockchain or building and purchasing Dapps on the platform. In fact, the Ethereum network was changed in 2021 to expend, or burn off, some of the Ether used in each transaction to align the use case. You will hear these sorts of tokens referred to as Infrastructure Tokens.

Service Tokens

Some cryptocurrency projects issue Service Tokens that grant the holder access to or allow them to perform something on a network. One such type of this service token is Storj, an alternative to Google Drive, Dropbox, or Microsoft Onedrive. The platform rents unused hard drive space to those looking to store data in the Cloud.

These users would pay for the service in Storj’s native utility token. To earn these tokens, those who are storing the data must pass random file verification cryptographically every hour to ensure that the data is still in their possession.

Finance Tokens

Another example of a token is Binance’s Binance Coin (BNB), which was created to give the holder discounted trading fees. As this type of token grants access to a cryptocurrency exchange, you will sometimes hear it referred to as an Exchange Token.

Tokens are most commonly sold by Initial Coin Offerings (ICO), which connects early-stage cryptocurrency projects to investors. The ones that represent ownership or other rights to another security or asset are called Security Tokens, a type of fractional ownership. More broadly speaking, exchange and security tokens belong to a larger class of Financial Tokens related to financial transactions, such as borrowing, lending, trading, crowdfunding, and betting.

Governance Tokens

Another interesting use of tokens is for governance purposes. These tokens give its holders a right to vote on certain things within a cryptocurrency network. Generally, these tend to bigger and more significant changes or decisions and is necessary to maintain the decentralized nature of the network. This allows the community, through their votes, to decide on proposals, rather than focus the decision-making power in a small group.

An example would be a DAO (Decentralized Autonomous Organizations), which are a type of virtual cooperatives. The most famous of these is the Genesis DAO. More currently, the MakerDAO has a separate governance token, called the MKR. Holders of MKR get to vote on decisions pertaining to MakerDAOs stablecoin, called Dai.

Media and Entertainment Tokens

Lastly, there are also Media and Entertainment Tokens, which are used for content, games, and online gambling. An example is Basic Attention Token (BAT), which awards tokens to users who opt-in to view advertisements, which then can be used to top content creators.

Non-Fungible Tokens (NFTs)

You might wonder why another commonly heard token hasn’t been mentioned. Non-Fungible Tokens (NFTs) are certainly one of the hottest topics in the Decentralized Finance (DeFI) space. However, NFTs are not a cryptocurrency as cryptocurrencies are fungible – meaning one unit of a particular cryptocurrency is identical to the next.

A holder of one BTC should be completely indifferent if another person offers them another unit of BTC. Same for any cryptocurrency. However, for NFTs, each one is unique and non-fungible, so we don’t include them as a cryptocurrency.

Stablecoins

Given the volatility experienced in many digital assets, stablecoins are designed to provide a store of value. They maintain their value because while they are built on a blockchain, this type of cryptocurrency can be exchanged for one or more fiat currencies. So stablecoins are actually pegged to a physical currency, most commonly the U.S. dollar or the Euro.

The company that manages the peg is expected to maintain reserves in order to guarantee the cryptocurrency’s value. This stability, in turn, is attractive to investors who might use stablecoins as a savings vehicle or as a medium of exchange that allows for regular transfers of value free from price swings.

The highest profile stablecoin is Tether’s USDT, which is the third-largest cryptocurrency by market capitalization behind Bitcoin and Ether. The USDT is pegged to the US dollar, meaning its value is supposed to remain stable at 1 USD each. It achieves this by backing every USDT with one US dollar worth of reserve assets in cash or cash equivalents.

Holders can deposit their fiat currency for USDT or redeem their USDT directly with Tether Limited at the redemption price of $1, less fees that Tether charges. Tether also lends out cash to companies to make money.

However, stablecoins aren’t subject to any government regulation or oversight. In May 2022, another high-profile stablecoin, TerraUSD, and its sibling coin, Luna, collapsed. TerraUSD went from $1 to just 11 cents.

The problem with TerraUSD was that instead of investing reserves into cash or other safe assets, it was backed by its own currency, Luna. During its crash in May, Luna went from over $80 to a fraction of a cent. As holders of TerraUSD clamored to redeem their stablecoins, TerraUSD lost its peg to the dollar.

The lesson here again is to do your due diligence before even buying stablecoins by looking at the whitepaper and understanding how the stablecoin maintains its reserves.

Central Bank Digital Currencies (CBDC)

Central Bank Digital Currency is a form of cryptocurrency issued by the central banks of various countries. CBDCs are issued by central banks in token form or with an electronic record associated with the currency and pegged to the domestic currency of the issuing country or region.

Since this digital currency is issued by central banks, the central banks maintain full authority and regulation over the CBDC. The implementation of a CBDC into the financial system and monetary policy is still in the early stages for many countries; however, over time it may become more widely adopted.

Like cryptocurrencies, CBDCs are built upon blockchain technology that should increase payment efficiency and potentially lower transaction costs. While the use of CBDCs is still in the early stages of development for many central banks across the world, several CBDCs are based upon the same principles and technology as cryptocurrencies, such as Bitcoin.

The characteristic of the currency being issued in token form or with electronic records to prove ownership makes it similar to other established cryptocurrencies. However, as CBDCs are effectively monitored and controlled by the issuing government, holders of this cryptocurrency give up the advantage of decentralization, pseudonymity, and lack of censorship.

CBDCs maintain a “paper trail” of transactions for the government, which can lead to taxation and other economic rents to be levied by governments. On the plus side, in a stable political and inflationary environment, CBDCs can be reasonably expected to maintain their value over time or at least track the pegged physical currency.

In addition to having the full faith and credit of the issuing country, buyers of CDBCs would also not have to worry about fraud and abuse that has plagued many other cryptocurrencies.

Introduction to Cryptocurrency Learning Objectives

Upon completing this course, you will be able to:

- Understand the historical definition and characteristics of money

- Examine the present landscape of how value is exchanged in the digital age

- Comprehend what blockchain technology is, its limitations, and how it is used

- Define what cryptocurrency is and how it is similar to and differs from fiat money

- Be able to explain how cryptocurrencies are held

Introduction to Cryptocurrency Is a Required Part of CFI’s Cryptocurrency Bundle

Introduction to Cryptocurrency is the first course in the Cryptocurrency Bundle, which focuses on the new and exciting world of Crypto and Decentralized Finance. These courses will start by teaching the learner the fundamentals of currency, blockchains, crypto technology and decentralized digital value exchange. We’ll look in-depth at some of the leading Cryptocurrencies as well as explore how this new asset class is evolving with both unprecedented demand and increasing regulation.

Who Should Take This Introduction to Cryptocurrency Course?

This Introduction to Cryptocurrency course is aimed at learners who want to improve their basic understanding of cryptocurrencies. The aim of the course is to provide learners with the foundations and tools to properly assess opportunities in this interesting new space.

Cryptocurrency Exchanges

What are cryptocurrency exchanges?

In order to start buying and selling cryptocurrencies and other digital assets, the most common way is to transact with Crypto Exchanges. Cryptocurrency exchanges are privately-owned platforms that facilitate the trading of cryptocurrencies for other crypto assets, including digital and fiat currencies and NFTs.

Key Highlights

- The most common way of transacting in cryptocurrencies and other digital assets is via a Cryptocurrency Exchange.

- There are Centralized and Decentralized Cryptocurrency Exchanges, and each offers advantages and disadvantages.

Centralized Cryptocurrency Exchanges (“CEX”)

Centralized cryptocurrency exchanges act as an intermediary between a buyer and a seller and make money through commissions and transaction fees. You can imagine a CEX being similar to a stock exchange but for digital assets.

Popular crypto exchanges are Binance, Coinbase Exchange, Kraken, and KuCoin. Much like stock trading websites or apps, these exchanges allow cryptocurrency investors to buy and sell digital assets at the prevailing price, called spot, or to leave orders that get executed when the asset gets to the investor’s desired price target, called limit orders.

CEXs operate using an order book system, which means that buy and sell orders are listed and sorted by the intended buy or sell price. The matching engine of the exchange then matches buyers and sellers based on the best executable price given the desired lot size. Hence, a digital asset’s price will depend on the supply and demand of that asset versus another, whether it be fiat currency or cryptocurrency.

CEXs decide which digital asset they will allow trading in, which provides a small measure of comfort that unscrupulous digital assets may be excluded from the CEX.

Decentralized Cryptocurrency Exchanges (“DEX”)

A decentralized exchange is another type of exchange that allows peer-to-peer transactions directly from your digital wallet without going through an intermediary. Examples of DEXs include Uniswap, PancakeSwap, dYdX, and Kyber.

These decentralized exchanges rely on smart contracts, self-executing pieces of code on a blockchain. These smart contracts allow for more privacy and less slippage (another term for transaction costs) than a centralized cryptocurrency exchange.

On the other hand, even though smart contracts are rules-based, the lack of an intermediary third party means that the user is left to their own, so DEXs are meant for sophisticated investors.

Advantages of Centralized Cryptocurrency Exchanges

1. User-friendly

Centralized exchanges offer beginner investors a familiar, friendly way of trading and investing in cryptocurrencies. As opposed to using crypto wallets and peer-to-peer transactions, which can be complex, users of centralized exchanges can log into their accounts, view their account balances, and make transactions through applications and websites.

2. Reliable

Centralized exchanges offer an extra layer of security and reliability when it comes to transactions and trading. By facilitating the transaction through a developed, centralized platform, centralized exchanges offer higher levels of comfort.

3. Leverage

One of the other benefits of certain CEXs is the option to leverage your investments using borrowed money from the exchange, called margin trading. It allows investors to reap higher returns, but losses can also be amplified.

Disadvantages of Centralized Cryptocurrency Exchanges

1. Hacking risk

Centralized exchanges are operated by companies that are responsible for the holdings of their customers. Large exchanges usually hold billions of dollars worth of bitcoin, making them a target for hackers and theft.

An example of such an incident is Mt.Gox, which was once the world’s largest cryptocurrency exchange company before it reported the theft of 850,000 bitcoins, leading to its collapse.

2. Transaction fees

Unlike peer-to-peer transactions, centralized exchanges often charge high transaction fees for their services and convenience, which can be especially high when trading in large amounts.

3. Custody of digital assets and risk of fraud

Lastly and most importantly, most CEXs will hold your digital asset as a custodian in their own digital wallet rather than allow you to store your private keys on your own digital wallet. While more convenient when you want to trade, there are drawbacks, namely the risk of the centralized cryptocurrency exchange failing and fraud.

Recent examples include the failure of the 50 USD billion algorithmic stablecoin TerraUSD and sister token Luna, the bankruptcies of hedge fund Three Arrows Capital, lender Celsius Network, broker Voyager Digital and the sudden collapse of FTX and Alameda Research.

Advantages of Decentralized Cryptocurrency Exchanges

1. Custody

Users of decentralized exchanges do not need to transfer their assets to a third party. Therefore, there is no risk of a company or organization being hacked, and users are assured of greater safety from hacking, failure, fraud, or theft.

2. Preventing market manipulation

Due to their nature of allowing for the peer-to-peer exchange of cryptocurrencies, decentralized exchanges prevent market manipulation, protecting users from fake trading and wash trading.

3. Less censorship

Decentralized exchanges do not require customers to fill out know-your-customer (KYC) forms, offering privacy and anonymity to users. Since DEXs don’t exercise censorship, more cryptocurrencies and digital assets are available than through a CEX. As a matter of fact, many Altcoins are only available on DEXs.

Disadvantages of Decentralized Cryptocurrency Exchanges

1. Complexity

Users of decentralized exchanges must remember the keys and passwords to their crypto wallets, or their assets are lost forever and cannot be recovered. They require the user to learn and get familiar with the platform and the process, unlike centralized exchanges, which offer a more convenient and user-friendly process.

2. Lack of fiat payments

DEXs are best for investors looking to switch from one digital asset to another and not well suited for someone looking to buy or sell digital assets with fiat currency, called on and off-ramping. It makes them less convenient for users that do not already hold cryptocurrencies.

3. Liquidity struggles

Some 99% of crypto transactions are facilitated by centralized exchanges, which suggests that they are accountable for the majority of the trading volume. Due to the lack of volume, decentralized exchanges often lack liquidity, and it can be difficult to find buyers and sellers when trading volumes are low.

The 10 Top Cryptocurrency Exchanges, Ranked by Volume (as of Nov. 2022)

Top Centralized Exchanges[1]

The following are the top centralized cryptocurrency exchanges, according to traffic, liquidity, and trading volumes.

- Binance

- Coinbase Exchange

- Kraken

- KuCoin

- Binance.US

- Bitfinex

- Gemini

- Coincheck

- Bitstamp

- Bybit

Top Decentralized Exchanges[2]

Below are the highest-ranked decentralized cryptocurrency exchanges, according to traffic, liquidity, and trading volumes:

- Uniswap (v3)

- dYdX

- Curve Finance

- Kine Protocol

- PancakeSwap (v2)

- DODO (Ethereum)

- Sun.io

- ApolloX DEX

- Uniswap (V2)

- Perpetual Protocol

Is cryptocurrency a good investment?

Is Cryptocurrency a Good Investment?

With trillions of dollars invested and all the hype in cryptocurrencies and new crypto projects being rolled out daily, the question that many investors are asking themselves is whether cryptocurrencies are a good investment.

Despite investors losing most, if not all, of their investment in scams like the Squid Game token, TerraUSD stablecoin, and other altcoins, is it still wise to invest in cryptocurrencies? Even with the incredible volatility experienced so far and stories about crypto millions made or lost overnight, would a prudent investor still look at putting their money into the market?

Summary

- Cryptocurrency can be a great investment with astronomically high returns overnight; however, there is also a considerable downside.

- Investors should analyze whether their time horizon, risk tolerance, and liquidity requirements fit their investor profile.

- Investors need to do their homework, allocate an appropriate amount of their investment, and learn how to actually invest.

What to Consider First?

Before you decide on any investment, you should look at asset allocation. Simply put, asset allocation means spreading your investments across various instruments to provide diversified returns over the long run. The same applies to cryptocurrencies: you should decide on your risk tolerance, financial goals, and timeframe to decide how much of your investment portfolio can be allocated to cryptocurrencies.

You should research and conduct due diligence on the cryptocurrency or digital asset you are considering. Simply listening to a friend’s hot tip or buying digital assets out of fear of missing out (FOMO) is not recommended. For any crypto-asset investment, it would be wise to read the whitepaper in order to better understand the cryptocurrency’s purpose, technology, and use case.

Understanding the team also gives you a sense of the track record of the people responsible. Ultimately, given the lack of regulation and oversight of digital assets, you want to avoid the risk of trading a crypto asset that collapses due to fraud.

Once you find a crypto asset you are comfortable investing in, you need to decide how to invest in it. Do you buy the crypto asset directly? If so, will you use your account at the crypto exchange or broker to hold your investment, or will you hold it yourself? If so, do you have a digital wallet set up? Or will you choose to invest via exchange-traded funds or an asset manager, like a hedge fund or mutual fund?

Do you decide that you want to invest by proxy and buy the stocks of crypto exchanges? Or buy stocks in other publicly listed companies that are involved in blockchain technology or supply the sector, like GPU manufacturers? Each one of these investments comes with its own pros and cons, and the prudent investor would weigh all of the given options.

Is cryptocurrency a good investment for you?

Firstly, we need to make the distinction between investing and trading, with the biggest difference being the time horizon. With trading in any asset, the time horizon tends to be short-term and often more speculative in nature. It is not rare for traders to execute dozens of trades a day to take advantage of intra-day price fluctuations.

Related Topics:

What is blockchain technology? How does blockchain work? “Blockchain Omniscience”

Bitcoin Explained Course Overview

Trading vs Investing

Trading is approached with discipline, as those who are most successful carefully manage their exposures. On the other hand, investing is also a disciplined plan that meets specific financial goals over a longer period of time, usually five years or more. Investors may build a strategy in order to save for college, purchase a house, or plan for retirement.

Next, you need to examine your risk tolerance. As cryptocurrencies experience volatility, whether they are a good investment depends on how much risk you can bear. If even small swings in prices keep you up at night, higher-volatility investments may not be a suitable investment for you.

With crypto assets experiencing levels of price volatility that aren’t too different from those experienced by other asset classes, such as growth stocks or high-yield bonds, they are risky assets. You need to be prepared to face fairly significant price swings or potential losses.

Liquidity constraints

One further consideration is the liquidity constraints that face certain crypto assets. Liquidity is simply the relative ease or difficulty with which one can buy or sell a certain asset when they want to without moving the price significantly.

As an example, if you are looking to buy a rare automobile, there are so many of them around, and if you can find one, the price you will pay is effectively what the seller commands. If you buy it, the next seller will certainly command a higher price for the next buyer, making the market very illiquid.

However, if you are looking to buy something more generic, say some Japanese yen, in exchange for your U.S. dollars, there is ample liquidity, so the price you pay for the yen will be whatever the market lies. The next buyer of the yen will also likely purchase the yen at or near the same price you transacted, as there is abundant liquidity among sellers of JPY who will accept UD in return.

Certain cryptocurrencies are more liquid than others, which means that to invest in such cryptos, you must be prepared to deal with the illiquidity when you buy and potentially when you sell. A worst-case scenario would be the inability to sell your crypto investment when you need to, due to a lack of liquidity in that particular cryptocurrency.

Benefits of Investing in Cryptocurrency

So far, we’ve discussed some of the main considerations that investors need to be cautious about, but there are certainly positive arguments about whether cryptocurrencies are a good investment as well.

1. New asset class

As cryptocurrencies mature and develop, such as we’ve seen with Bitcoin and Ethereum, we also see the emergence of such assets as a new asset class. To be sure, we’ve seen large professional fund managers, such as Cathy Wood from Ark Investment Management, create dedicated investment funds solely investing in Bitcoin and other cryptos.

2. Diversification

The said institutional investors also look to diversify their risks by keeping different investments that behave differently under the same economic conditions. Some argue that cryptocurrencies provide positive diversification effects, specifically against rising inflation.

Moreover, we’ve seen the development of more investment instruments that capture the upside of not only specific cryptocurrencies, such as options and futures on Bitcoin and Ethereum, but also specific investment funds that professionally manage cryptocurrencies on behalf of investors.

3. Upside potential

Lastly, one more positive is the fact that the sector is quite new, and as such, there are potentially many more changes that may come down the line to make investing in cryptocurrencies even more attractive. Examples are stablecoins, which are cryptocurrencies that are linked to the value of a fiat currency and assets to back the digital currency.

For those who worry about fraud, there can be more stringent regulations on how to deal with initial Initial Coin Offerings, to help protect investors. We mentioned futures on cryptocurrencies, and as the market develops, there can be futures on other cryptocurrencies that are traded on a reputable exchange. Futures also allow cryptocurrency bears to sell the asset short, thereby improving liquidity overall.

follow me : Twitter, Facebook, LinkedIn, Instagram

3 thoughts on “Cryptocurrency”

Comments are closed.